If you’re considering to invest your hard earned money somewhere then it is very essential to know if your investment is safe or not? One option that’s gaining attention is Xtra Mobikwik. But is it a secure place to put your money? Let’s clear all your doubts.

I have been an active investor in Xtra By Mobikwik since last 4 Months and that is why I am sharing all the details and experience with all of you today with practical examples and screenshots.

What is Xtra Mobikwik?

Xtra is an investment platform that allows you to invest your money and potentially make some extra income.

You can earn up to 12% per year by lending your money directly to people who are good at repaying loans.

Xtra Mobikwik Investment Plans

There are two investment plans offered by Xtra Mobikwik:

1. Flexi: if you invest in Flexi plan then you will get assured returns of 12% per Year.

2. Plus: if you want to invest in Xtra Plus then you will get assured returns of 12.99% p.a with a condition of minimum 3 Months Lock-in.

There is no Deposit Fee for investment in both the plans, the only limitation difference is lock-in period for investing in Xtra Plus.

Xtra Mobikwik User Review

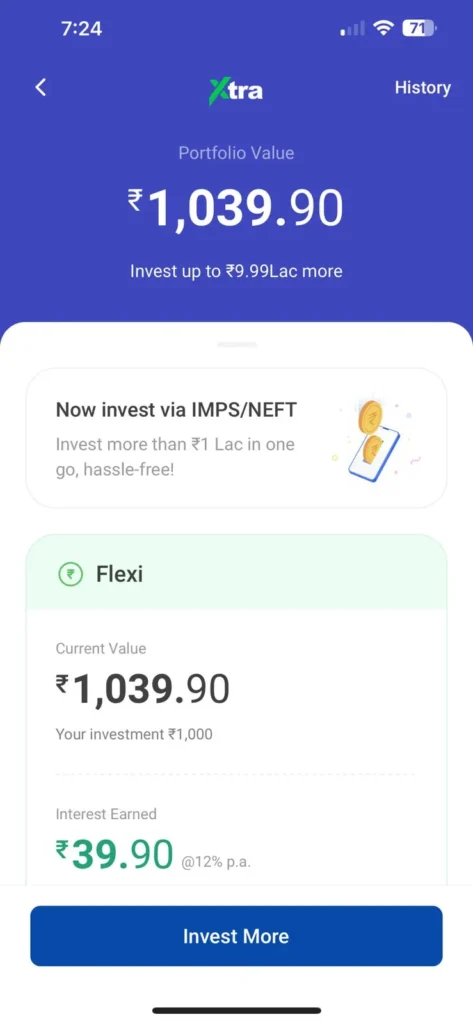

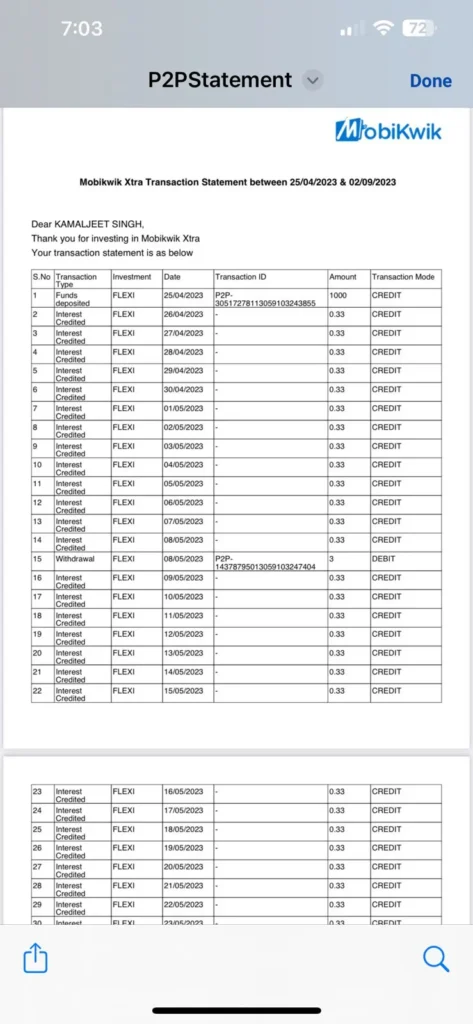

In this review, I will show you my own investment account at Xtra Mobikwik along with the official statement till August 2023.

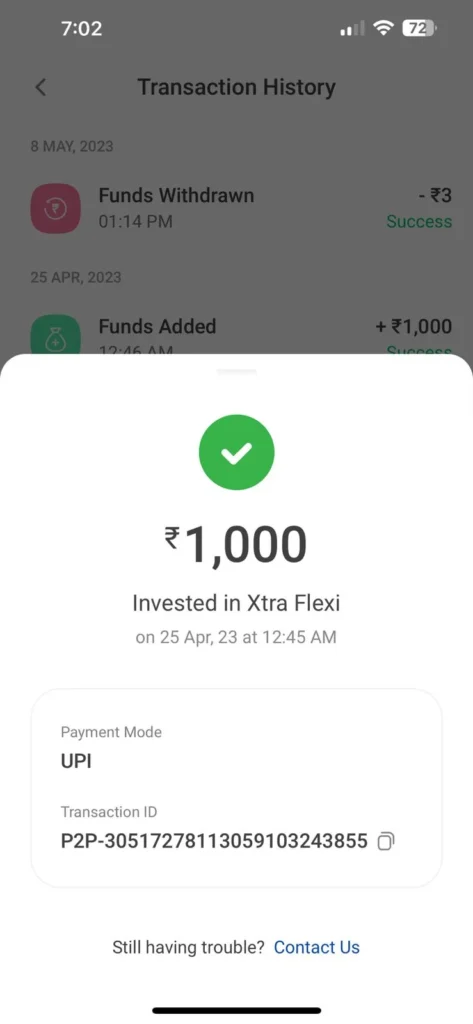

For demonstration purpose I invested only 1000 rupees on Xtra Flexi Plan through UPI on 25 April 2023 as you can see in the screenshot below.

Now, This plan offers 12% returns p.a which means I should get 1% returns per month and about 0.33% per day.

You can check out my personal account statement below which shows daily credit of 0.33 rupees in my account and the total amount has become 1039 till now.

So, My overall experience with Xtra is good and if you are looking for a hassle free investment where you don’t have to keep a daily track of the market fluctuations then Xtra can be a better option for you to earn upto 13% returns per Year.

Is Mobikwik Xtra Safe or Not?

It is completely safe investment option as all the transactions that occur in Xtra are through an RBI regulated platform called Lendbox.

Mobikwik Xtra Withdrawal Problem

I did not encountered any problem while withdrawing money from Xtra till now. As shared in the personal account details above, you can see I have successfully withdrawn some amount for checking the the withdraw process.

Is Mobikwik Xtra RBI Approved?

The transactions in Xtra happens through a special platform called Lendbox, which is regulated by the Reserve Bank of India (RBI). It’s like you’re helping people by lending them money, and in return, you can earn a nice interest rate on your investment.

How to Invest in Xtra Mobikwik?

If you want to start your investment journey with Xtra then just follow simple steps given below:

Step 1: Click Here to Download Mobikwik Xtra.

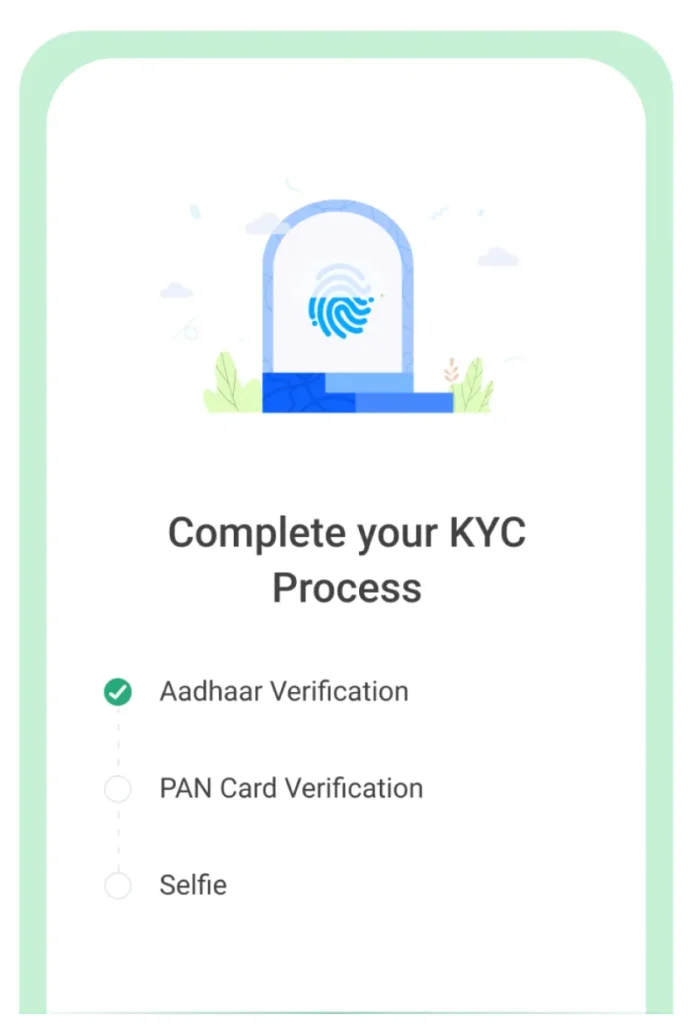

Step 2: Proceed to Complete the KYC process with Aadhar, Pan Card and Selfie.

Step 3: Click on Xtra Option in the App.

Step 4: Add Money Using UPI and that’s it. You are not invested into Xtra and will receive daily interest on your Invested amount which you can withdraw anytime.

Xtra Mobikwik Referral Code

If you have already downloaded the Mobikwik App and want to invest in the Xtra. Then you can use my referral code given below:

UWF5CU

Copy the referral code above and use while signing up on Mobikwik to start investing in Xtra Mobikwik Platform.

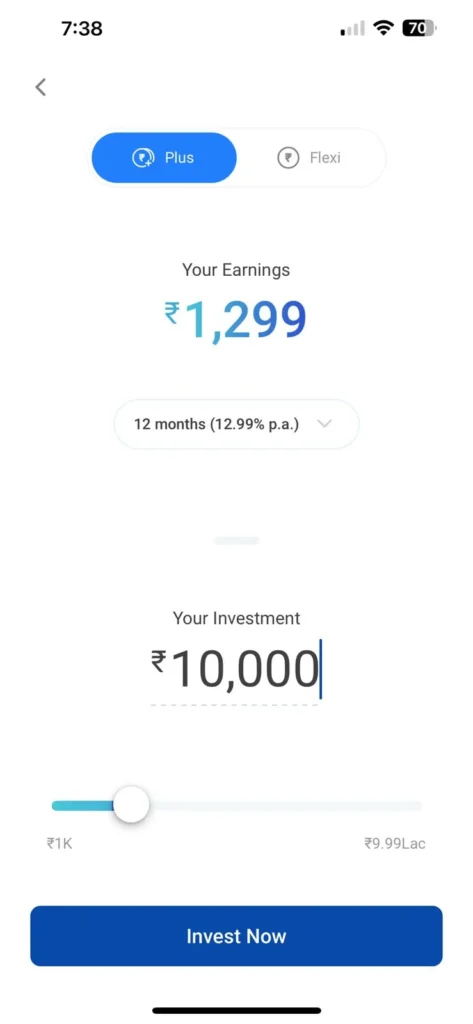

Mobikwik Xtra Calculator

You will see the Xtra Investment Calculator within the Mobikwik App. Just go to Mobikwik Homepage and then click on Xtra.

This will show up the Xtra Calculator. Put in the amount you want to invest, select plan and it will instantly calculate the amount of return that you will earn in an year.

Conclusion

This is all about Xtra Mobikwik Review. If you have anything else to ask then you can ask in comments or feel to Contact Me for personal assistance.