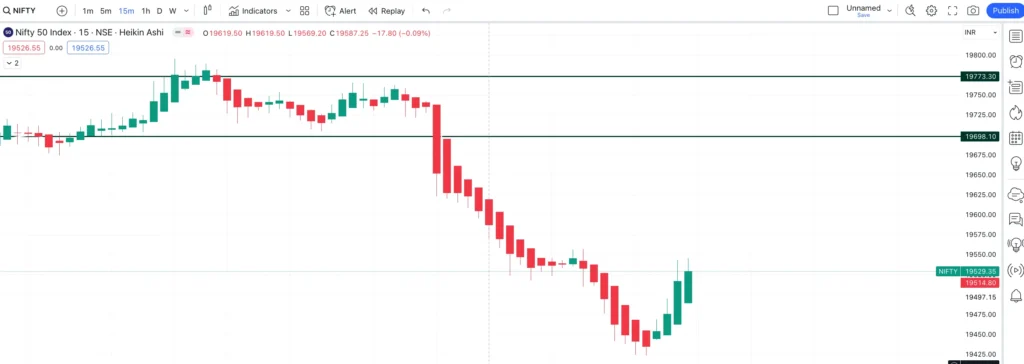

Indian Markets today on 02 August 2023 opened gap down due to negative global sentiment and even after opening the Nifty, Banknifty and Sensex Fell sharply for the whole day.

Nifty closed down by 207 points which is about 1% of the Index, Sensex Closed 676 Points down which is about 1.02% and Banknifty fell by 596 Points which is 1.31% of the index.

What is the reason behind this Fall?

The main reason for Why Share Market is Down Today can be the impact of US Market. As you may already have heard the news of Fitch Downgrading US from long term rating to AA+ from AAA. This is first time that a rating company like Fitch have given negative ranking to the United States.

Yesterday this news had a significant impact on the US Market due to which Dow Jones fell down by about 270 Points.

As you all know that share market runs on the sentiments and the money. Also, all the world markets are interconnected specially Indian market is connected to the sentiment of US market.

We generally see impact on Indian Market if there is some good or Bad news in the US and European Markets.

Is this Impact Significant?

If we see, Indian indices are down by approximately 1% which is not a major downfall or we cannot call it a crash or something like that.

However, there was a good momentum that too directional in the market so in my view, day trader could have made good profits but long term investors may see reds in their portfolios.

We have shared another post where Banknifty PE options have doubled the investment of traders in just two hours, don’t for get to check out this post BANKNIFTY 03AUG23 45500 PE Went from 200 to 547 in just 2 Hours.