Tata Power will be releasing its company results tomorrow on 09 August 2023. It will be a great opportunity for traders to capture the trend based on the result sentiment tomorrow.

In this post, we will discuss about TATA POWER Q1 Results and how the price can react to this result before August Expiry, so that Equity traders can make a strategy and book good profits.

TATA POWER Q1 Results

Tata Power is ready to announce its results for the July Quarter 2023 on 09 August 2023 and the stock price on 08 August 2023 closed at 233.90

Earnings Strategy For Tata Power Options

Now, Let’s make a profitable strategy to take advantage of price fluctuation based on Q1 results of Tata power. We will discuss two views and formulate strategy based on it:

Volatile View

If you think that the impact of news will be the volatile movement in the price of Tata Power Stock then you can follow the given trade plan of Option Buying and Option Selling.

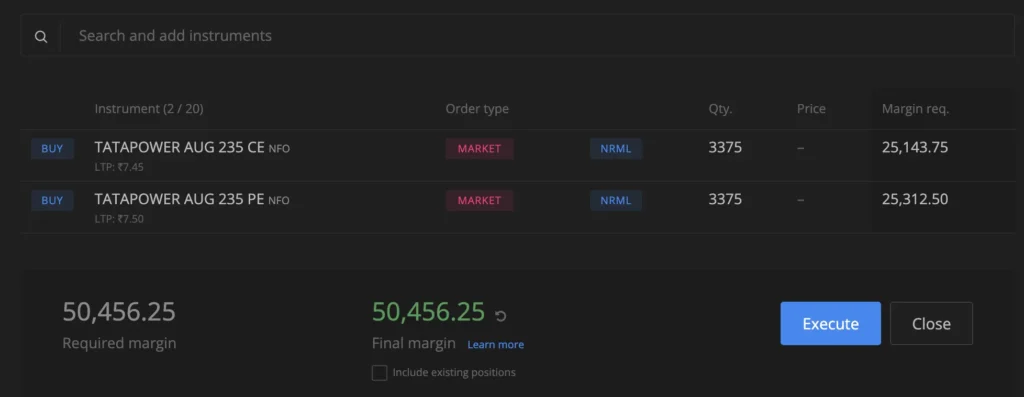

- Buy ATM CE of 235

- Buy ATM PE of 235

Estimated Required Fund: ₹51k

Neutral View

If you think that the impact of Q1 result will be Neutral then we have an Option Selling Plan for you with managed risk opportunity:

- Sell ATM CE with Strike Price 235

- Sell ATM PE with strike Price 235.

Estimated Required Fund: ₹135k

Conclusion

If you are a safe trader then you can go with these two suggested strategies based on my analysis and an experienced trader can watch the price action and go naked as well but do not forget to trail you positions and make most out of a wining trade.

I hope you like our analysis for TATA Power F&O Earning strategy, if you find it useful then let us know in the comments section below.

Also Read: Concord Biotech Limited IPO GMP & Subscription Status on the Last Day