Have you ever thought of becoming a Crorepati with the Power of SIP in India? Yes, it’s possible, and you don’t need a massive amount to get there. Surprisingly, investing as little as 3000, 9000, or 10000 rupees every month can pave your way to Crorepati status in India.

How does this magic happen?

It’s the power of systematic investment planning, commonly known as SIP. SIP is like a fitness regimen for your finances, steadily building wealth over time through disciplined investing.

The SIP Way to Crorepati Status

Imagine you start an SIP with:

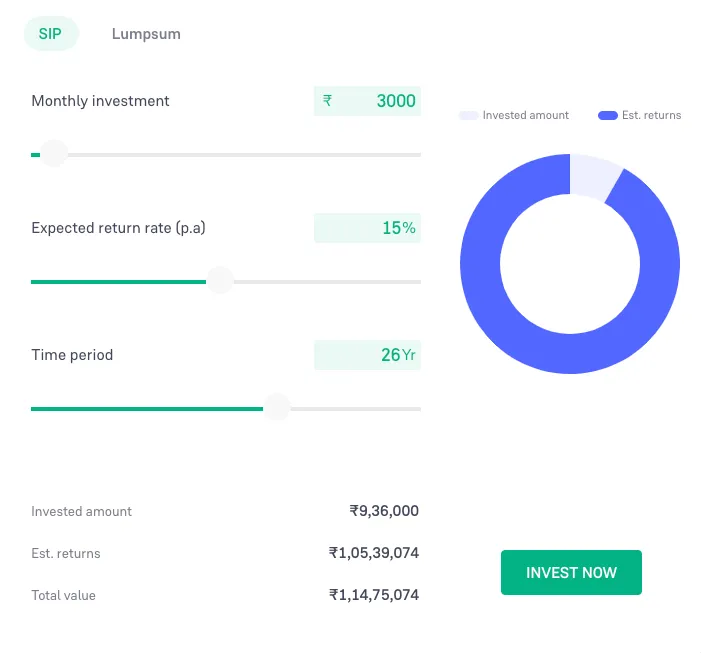

- 3,000 Rupees per month: Suppose if you start an SIP of 3000 per month in a Top Mutual Fund which yields an average annual returns of 15%. After 26 Years you will be a crorepati having 1,14,75,074 Amount with the total investment of only 9,36000.

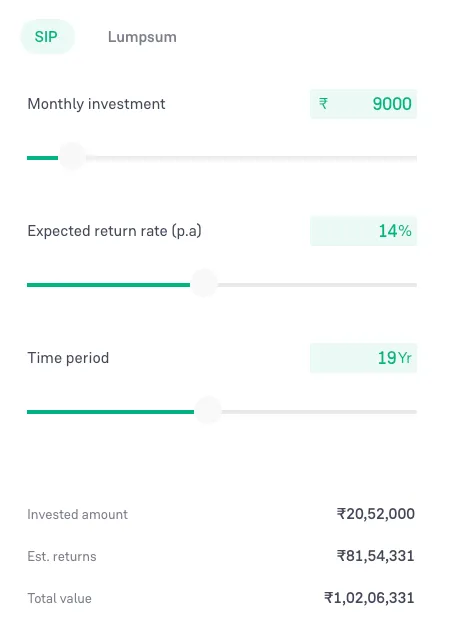

- 9,000 Rupees per month: Suppose if you start an SIP of 9000 per month in an EV Sector Mutual Fund which yields an average annual returns of 15%. After 19 Years you will be a crorepati having 1,02,06,331 Amount with the total investment of only 20,52,000

- 10,000 Rupees per month: Suppose if you start an SIP of 9000 per month in the Best Mutual Fund which yields an average annual returns of 20%. After 15 Years you will be a crorepati having 1,02,06,331 Amount with the total investment of only 20,52,000

The Magic of Compounding

The secret sauce behind SIPs is the power of compounding. It’s like a snowball effect. Your money earns returns, which then generate more returns. Over time, this compounds, helping your wealth grow exponentially.

Choosing the Right Investment

Selecting the right investment fund is crucial. Mutual funds, stocks, or other market-linked instruments can offer diverse opportunities. However, it’s important to choose according to your risk appetite and financial goals.

Discipline is Key

Consistency is the backbone of SIP success. By investing regularly, regardless of market fluctuations, you benefit from rupee cost averaging, buying more units when prices are low and fewer when they’re high. This helps in reducing the overall cost of investment.

Becoming a Crorepati might seem like a lofty goal, but with SIPs, it’s an achievable reality. It’s not about the amount you start with; it’s about the commitment to invest regularly and allow time and compounding to work their magic.

So, whether you can spare 3000, 9000, or 10000 rupees a month, kickstart your journey towards becoming a Crorepati. Start your SIP today, stay patient, and watch your wealth grow over time.

Remember, financial decisions should align with your goals and risk tolerance. Consider consulting a financial advisor for personalized guidance.

Invest wisely, and pave your way to Crorepati status with the power of SIPs!