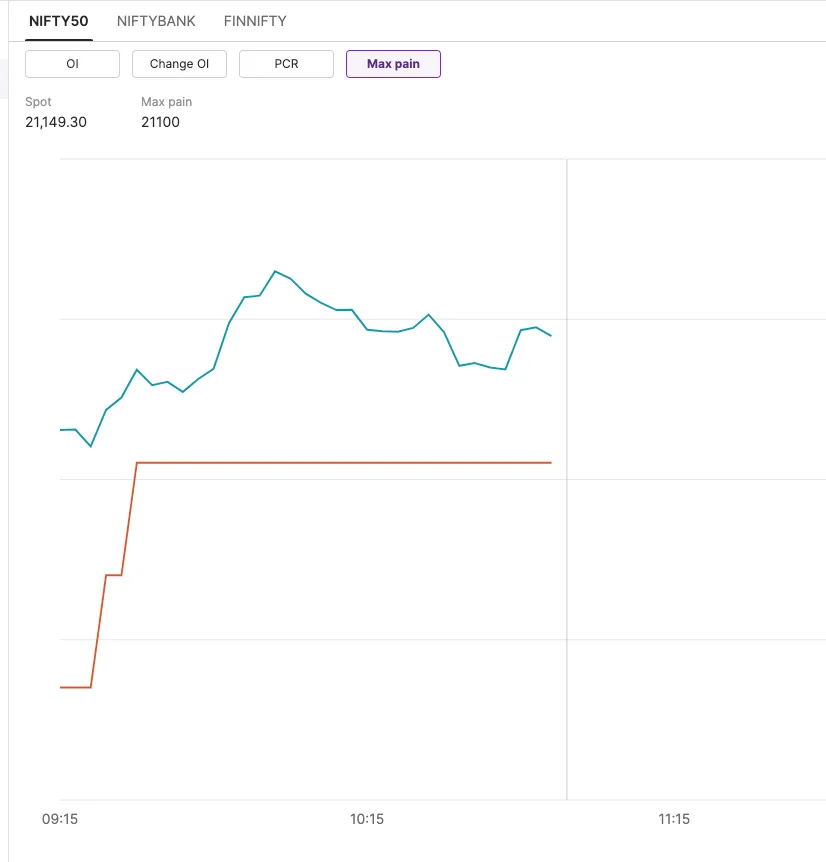

As of 10:48 PM in the Nifty Expiry scenario, positive indications are prevalent with the Put-Call Ratio (PCR) standing in the positive zone. The Nifty has witnessed a notable upswing, marking a significant gain of 225 points.

Interestingly, the Max Pain point has shifted from 21000 to 21100, suggesting a potential trajectory for the Nifty’s expiry around the 21100 mark. This shift in Max Pain indicates a higher probability for sellers to reap maximum benefits at this level.

Traders and investors are advised to keep a close eye on these developments as they navigate the market dynamics leading up to the Nifty expiry. Further updates will be crucial in understanding the evolving trends and making informed decisions in the dynamic financial landscape. Stay tuned for more detailed insights and analysis.

Also Read: Nifty Prediction for Tomorrow By Experts

In the latest market development, a fresh support level has been established at 21000. Traders are advised to exercise caution as the premium is expected to experience decay in light of today’s expiry. To mitigate risks, it is recommended to consider trading in the next expiry for a safer position.

This cautionary advice aims to help traders navigate the market dynamics prudently and make informed decisions to safeguard their positions amid the evolving market conditions. Stay tuned for further updates and insights as the market situation unfolds.