Nifty & Bank Nifty Post Market View Today: The market had a strong opening today, with a candlestick pattern called a “hammer” forming on the 5-minute chart. This pattern had a long lower tail, showing that there was significant buying interest at lower price levels.

In the Bank Nifty (BNF), the price quickly filled the gap in the very first 5-minute candle, while the Nifty did not fill the gap and instead rose sharply. BNF then formed an “inside candle” pattern and climbed about 50 points after breaking the day’s high. Nifty also remained above the day’s high without filling the gap.

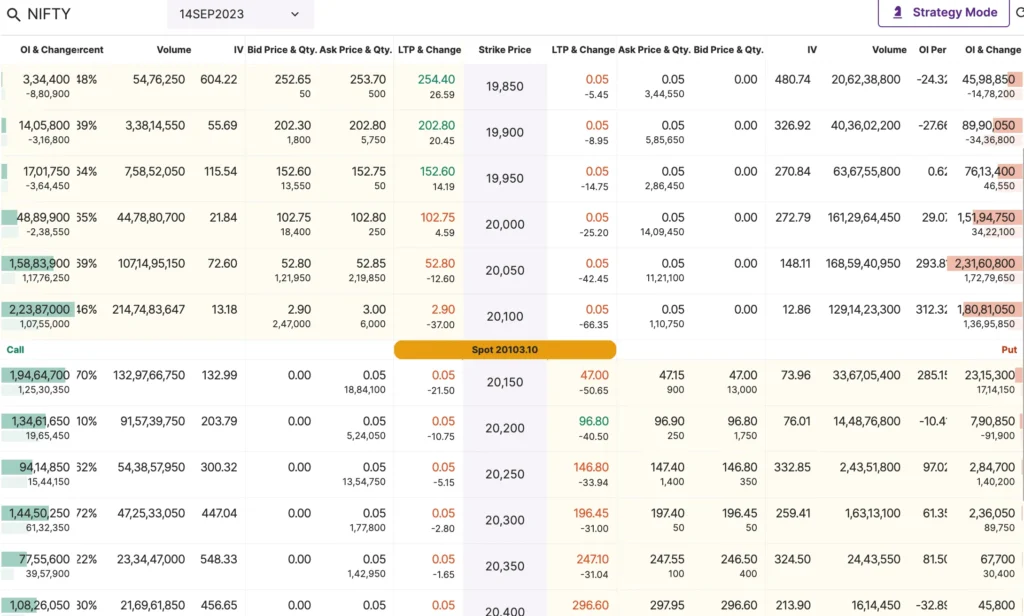

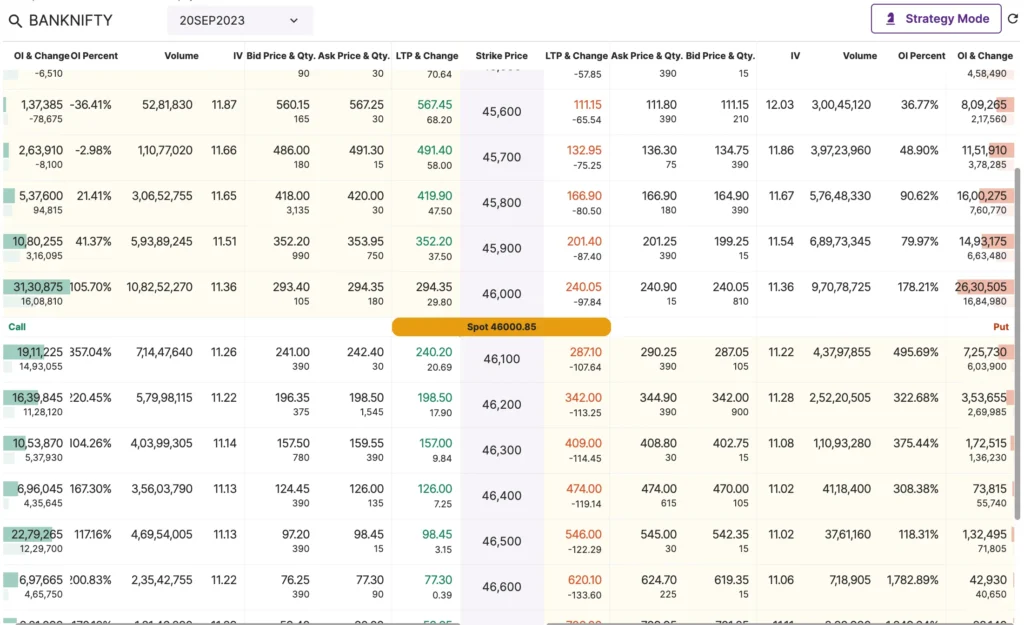

There was a notable increase in short positions at the 46,000 level in BNF and the 19,200 and 19,300 levels in Nifty. However, both indices experienced some profit-taking from their daily highs and began to fall sharply.

Nifty fell below its daily low and, after breaking through a significant support level at 20,093, dropped sharply, finding support at the swing levels from the previous day at 20,050. BNF also found support around the major swing levels at 45,840, with short positions being covered.

There was a significant increase in short positions at the 20,200 and 20,100 levels in Nifty, but there was substantial support at the 20,000 level, suggesting that Nifty might remain in this range. BNF started consolidating near the major level of 46,000.

Despite the market’s decline, the Volatility Index (VIX) remained in negative territory, indicating that the market was still favoring the bulls and that the upward movement might continue.

Both indices formed a “doji” candle on the daily timeframe, suggesting market indecision. Since it was Nifty’s expiry day, significant positions were expected to be built the following day.

The Put-Call Ratio (PCR) data for BNF dropped from 1.1 to 0.9 today, indicating weakening data strength. However, both indices closed near major support levels. By the end of the day, the VIX had fallen by 4%, suggesting that the market was still in favor of the bulls, and further upward movement might be expected.