Global growth is anticipated to maintain a subdued pace over the next 18 months due to the challenges faced by China, as highlighted by Chetan Ahya from Morgan Stanley. The Indian stock market gears up for the day with notable indicators and a mix of global cues.

Nifty: Support and Resistance Levels

The Nifty, the benchmark index of the National Stock Exchange (NSE), is likely to find support at 19,338, with resistance predicted at 19,425. The pivot point calculator suggests potential support levels at 19,311 and 19,268, and resistance at 19,452 and 19,495.

Also Read: Bank Nifty Prediction for Tomorrow By Experts

Nifty Bank’s Indecisiveness and Projection

The Bank Nifty formed a Doji candlestick pattern on November 6, indicating uncertainty among traders regarding future market trends. With a close above the 21-day moving average, Rupak De, a senior technical analyst at LKP Securities, forecasts a sideways to positive trend. The index is expected to find support at 43,472 and resistance at 43,650.

Asian and Global Market Overview

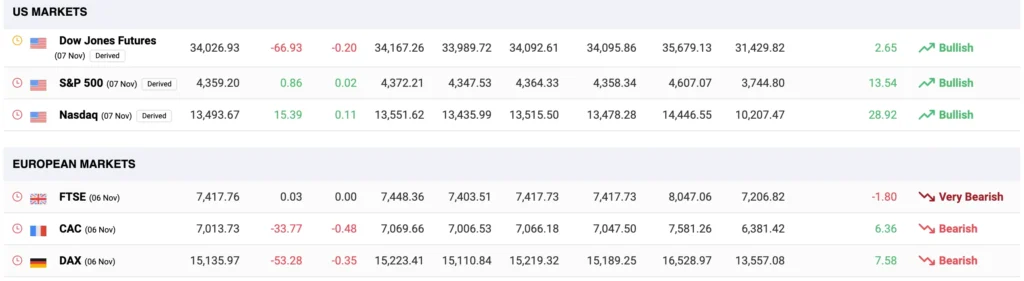

Asian stock market indexes exhibit a bearish trend on Tuesday ahead of crucial trade data from China and the Reserve Bank of Australia’s interest rate decision. South Korea’s Kospi dipped by 1.99%, while Australia’s S&P ASX 200 traded lower by 0.38%. Japan’s Nikkei and Shanghai’s market are also down, with cautious trading evident in Hang Seng and other indexes.

The US stock market closed marginally higher, witnessing a bounce in Treasury yields. Regional banking stocks experienced a dip while Tesla’s shares fluctuated, ending slightly lower despite plans to introduce electric vehicles at an affordable price.

European Market Insights

European stock markets closed lower, with profit booking observed after the prior week’s strong rally. Despite solid corporate earnings, markets pulled back, with the Stoxx 600 index ending 0.2% lower. Eurozone service sector PMIs indicated a contraction, influencing market sentiments.

Indian Stock Market Highlights

Indian equity benchmarks surged on Monday, buoyed by positive global cues and the US monthly job data. Market breadth remained robust, with a 3:1 advance-decline ratio. Foreign Institutional Investors (FIIs) were net sellers while Domestic Institutional Investors (DIIs) were net buyers.

Today’s Market Prediction

The Nifty is trading slightly lower, mirroring negative trends in Asian markets. Despite a positive outlook from the US, the Indian stock market is anticipated to open cautiously and might trade sideways.

In summary, amidst global uncertainties and varied market trends, Indian traders are advised to remain vigilant and watch key support and resistance levels for potential trading opportunities.

Also Read: Nifty Prediction for Tomorrow By Experts