Ever feel like you need a PhD in finance to pick the right stocks for swing trading? What if I told you that in just 10 minutes, you could master the art of selecting stocks that align with your trading strategy? Imagine having the power to identify those potential winners swiftly, without drowning in a sea of complex data.

In this blog post, we will simplify your stock selection process, making it quick, efficient, and dare I say it, even a bit exciting. Whether you’re a seasoned trader or just dipping your toes into the market. Get ready to revolutionize your approach to swing trading – your portfolio will thank you!

What is Swing Trading?

Swing trading is a style of trading in the stock market where investors aim to capture “swings” or short- to medium-term movements in a stock’s price. Unlike day trading, which involves making quick trades within a single day, swing trading typically holds onto stocks for a few days to weeks.

The idea is to take advantage of price fluctuations that happen as stocks go through up and down cycles. Swing traders analyze charts, trends, and patterns to identify potential entry and exit points, trying to profit from the price changes during these “swings” in the market. It’s a strategy that sits between the fast-paced world of day trading and the longer-term perspective of traditional investing.

How to Select Stocks for Swing Trading

The process involves creating a screener using specific filters for market cap and volume. The strategy emphasizes monitoring momentum stocks and avoiding impulsive trades. Overall, it’s a systematic approach to stock selection and trading with specific criteria and alert systems.

Before we dive into stock selection criteria, it’s essential to align your trading style with your psychological preferences. Whether you prefer ultra short-term or medium-term trading, understanding your holding period is crucial for successful swing trading.

In case, you don’t like to read much then you can just watch this video for practical explanation on How to Select Stocks For Swing Trading in Hindi.

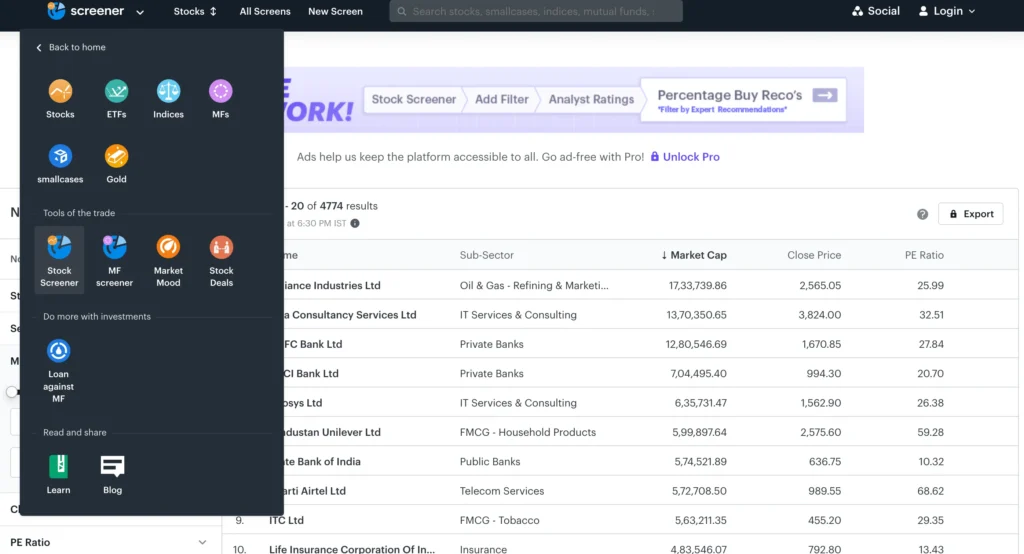

Steps To Find Swing Trading Stocks Using Ticketape Screener

- Go to Tickertape Screener.

2. Click on Stock Screener and choose a a new screener option.

Now you will see the list of all the stocks in Indian Stock Market. Now set the filters using the criteria given below:

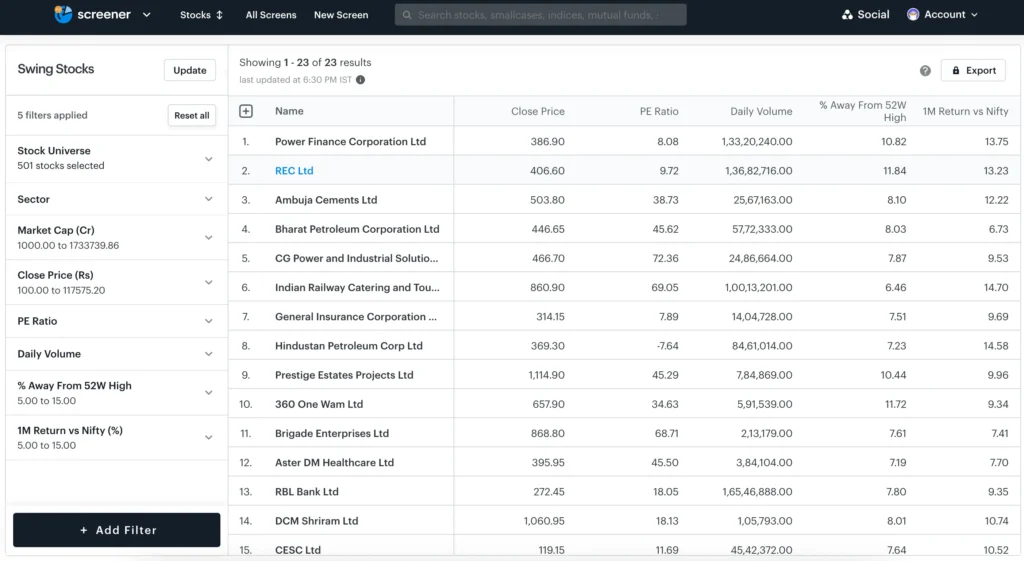

Criteria for Stock Selection:

- Stock Price: Avoid stocks with prices below 100, as they are more susceptible to market volatility. New market entrants should be avoided as well.

- Volume Liquidity: Opt for stocks with good liquidity, ensuring that they have a substantial trading volume. This liquidity indicates a healthy momentum in the market.

- Circuit Filters: Steer clear of stocks with unappreciated and lower circuit filters, as they can pose challenges in executing trades during extreme market conditions.

- Participation in Market Movements: Look for stocks with active participation in market movements. Analyze volume data to identify stocks with increased participation, indicating potential opportunities for swing trading.

- Relative Performance: Prioritize stocks that outperform the market index, such as Nifty. Ensure that the selected stocks have the potential to move higher than the market index.

After Implementing Stock Selection filters on Tickertape Screener, your final Screener will look like the image attached above.

How to Trade These Swing Stocks

There is a three criteria based simple strategy that I personally use to trade these swing stocks.

1. Identify the Stock Trend in Daily Time-Frame, it should be in Uptrend.

2. Mark Support & Resistance on 1 Hour Time Frame.

3. Make Entry & Exits based on these Levels without thinking much about anything else. You just have to But the stock on dip at 1 hour support level and sell when it reaches resistance or Trail.

Pro Tip: Do not wait for the % returns in this strategy. Just follow the simple rule that you have to Buy the 1 day uptrend stock at 1 hour support level and book profit at resistance, that’s it.

Wrapping Up!

Remember, the key to successful swing trading lies in precision, not complexity. Armed with our insights, you’re now equipped to sift through the noise, identify promising stocks, and execute trades with confidence.

So, the next time you’re strapped for time but itching to make strategic moves in the market, recall our tips on “How to Select Stocks for Swing Trading.” Your journey to more efficient, effective trading starts now. Happy trading!