In the wake of increasing number of traders and investors in the Indian Stock Market. There are many questions to their mind. While doing Research we have found one common question that arises is whether it’s possible to buy stocks after the market closes?

While Indian stock market has set trading hours, it doesn’t necessarily limit your trading options to those times. In this article, we will discuss this intriguing question and explain what to do for the solution.

Can We Buy Shares After Market Closes in India?

Yes, Now You Buy Stock After Market Closes using the AMO Order Facility. Traditionally, the stock market operates during regular trading hours, which typically span from 9:15 AM to 3:00 PM Indian Standard Time.

With the advent of electronic trading platforms and increased global connectivity, the boundaries of trading hours have expanded and among these is After Market Orders (AMO), a concept that has intrigued both seasoned investors and newcomers alike. But what exactly is after-hours trading, and how does it impact your ability to buy stocks outside of regular trading hours? Let’s learn in detail about this concept:

What is After-Hours Trading?

After-hours trading refers to the extended trading session that takes place outside of regular trading hours. This additional trading window allows investors to buy and sell stocks after the market closes for the day.

It’s important to note that after-hours trading is not a recent phenomenon; it has been around for quite some time, but it has gained prominence in recent years due to technological advancements.

How Does After-Hours Trading Work?

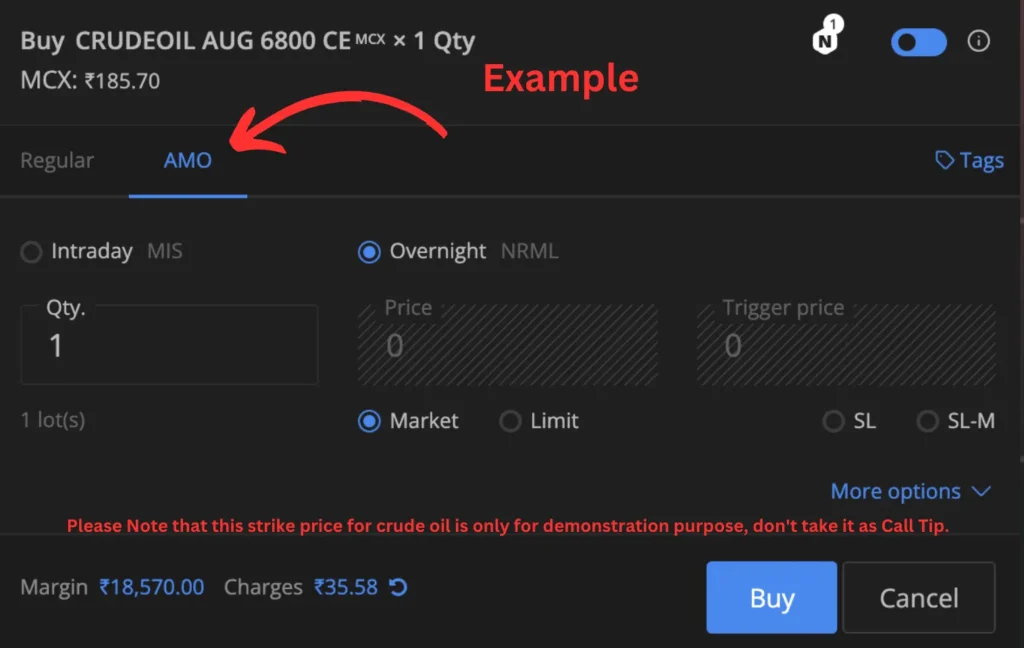

After-hours trading happens with the help of electronic networks like ECNs and alternative trading systems (ATSs). Many Indian stock brokers, such as Upstox and Zerodha, offer this service.

These systems allow people who want to buy and sell, letting investors trade stocks when the usual markets are shut. While after-hours trading works similarly to regular trading, there are important things to keep in mind:

Liquidity and Volatility

After-hours trading gives you more choices, but remember that how easy it is to buy and sell, and how much prices change, can be different from the usual trading times.

During these extra trading times, there are fewer people buying and selling, which can make the gap between prices bigger and cause prices to change more. This extra change in prices can be both a chance to gain and a chance for things to go wrong for people who invest.

Brokerage Policies

Before engaging in after-hours trading, it’s crucial to understand your brokerage’s policies. Some brokerages may offer limited after-hours trading, while others provide more extensive access.

Overnight Gaps

Overnight gaps occur when a stock’s price opens significantly higher or lower than its previous closing price. These gaps can be a result of after-hours trading activity and may impact your positions.

Pros and Cons of AMO Trading

There are several benefits as well as drawbacks of After Hour Trading listed below:

Benefits of After-Hours Trading

- Extended Accessibility: After-hours trading allows investors with busy schedules to participate in the market beyond regular hours.

- Reacting to News: Investors can respond to breaking news and corporate announcements that occur outside of trading hours.

- Potential Gaps: Price gaps between the previous closing price and the next opening price may provide profitable opportunities.

Risks of After-Hours Trading

- Limited Liquidity: Lower trading volumes can lead to challenges in executing trades at desired prices.

- Higher Volatility: Wider price fluctuations can result in unexpected losses if not carefully managed.

- Lack of Information: After-hours trading may have less information available, increasing the risk of uninformed decisions.

Conclusion

In today’s world of easily buying and selling stocks online, you can actually buy stocks even after the regular market closes, all because of after-hours trading. This extra time for trading gives investors chances to react to important news and maybe make more money as prices change.

While you explore after-hours trading, think about its special features, both good and risky, and how important it is to make smart choices. If you have anything to say about this then let us know in the comments below and don’t forget to react to this post using the emoji’s given below.