Investors are excited over the success of Aditya L1 and looking for the companies associated for growth opportunities and potential returns. But finding stocks linked to the Aditya L1 project can be quite intriguing, especially when you want to make sure that their Fundamental and technical aspects are in favour.

In this Post, we’ll provide a list of these Aditya L1 related stocks, making it easier for you to explore potential investment opportunities. So, let’s dive right in and uncover some exciting prospects in the world of Aditya L1-related stocks!

Aditya L1 Related Stocks List

| Stock | Listing Status |

| 1. ANANTH TECHNOLOGIES LIMITED | Unlisted |

| 2. MTAR TEXHNOLOGIES | Listed on NSE & BSE |

Two companies from Hyderabad, Ananth Technologies and MTAR Technologies, played a big role in making important parts and systems for ISRO’s Aditya-L1 solar mission. This helps India do better in space exploration.

Now, as Aditya-L1 starts its long journey of 1.5 million kilometers toward the Sun, these two Hyderabad companies are really excited and hoping for its success.

1. ANANTH TECHNOLOGIES LIMITED

Ananth Technologies Limited is a private company that started on August 17, 1992. It’s not traded on the stock market, so it’s called an unlisted public company, and its ownership is divided into shares.

| Date of Incorporation | 17 Aug, 1992 |

| Status | Active |

| Company Category | Company limited by Shares |

| Company Sub-category | Non-govt company |

| Company Class | Public |

| Business Activity | Business Services |

| Authorized Capital | 600.0 lakhs |

| Paid-up Capital | 439.35 lakhs |

| Paid-up Capital % | 73.224335 |

| Registrar Office City | Hyderabad |

| Registered State | Telangana |

| Registration Number | 14675 |

| Registration Date | 17 Aug, 1992 |

| Listing Status | Unlisted |

The company was authorized to have capital worth Rs 600.0 lakhs, and currently, 73.224335% of that capital, which is Rs 439.35 lakhs, has been paid by shareholders. The last time they had a meeting for all the company’s owners (Annual General Meeting or AGM) was on September 29, 2017. The most recent financial information available is from March 31, 2017, according to the Ministry of Corporate Affairs (MCA).

Ananth Technologies Limited has been in the business services industry for 31 years, and it’s still active. The people responsible for running the company are RAMAKRISHNA TUMMALA, SUBBA RAO PAVULURI, ANANTHALAKSHMI PAVULURI, SHASHI KUMAR VIJAYABALAN, HANUMANTHA RAO TAGIRISHA, NARAYANAN NARAYANAN, ANURUP PAVULURI, and NAGAVARDHINI THAGIRISA.

This company is registered in Hyderabad, Telangana, and its official address is PLOT NO.39, HITEC CITY, PHASE-II, MADHAPUR, HYDERABAD, TG 500081, INDIA.

2. MTAR TEXHNOLOGIES

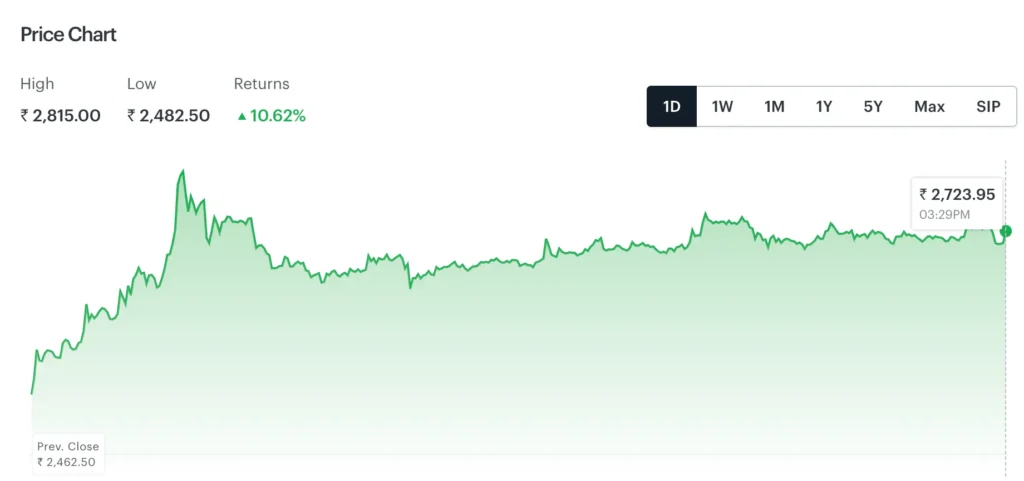

MTAR Technologies’ stock has received a significant boost after to some exciting news. The company has been granted a special license that allows it to make different mechanical and electronic parts for the defense industry.

| MARKET CAP | ₹ 8,378.76 Cr. |

| ENTERPRISE VALUE | ₹ 8,490.57 Cr. |

| NO. OF SHARES | 3.08 Cr. |

| P/E | 77.98 |

| FACE VALUE | ₹ 10 |

| BOOK VALUE (TTM) | ₹ 208.27 |

| PROMOTER HOLDING | 39.14 % |

| SALES GROWTH | 78.05% |

| PROFIT GROWTH | 70.95 % |

| DEBT | ₹ 142.79 Cr |

This company is quite important in the defense and aerospace fields, and investors are taking notice. This interest has grown even more, especially after the success of the Chandrayaan-3 mission.

In the past year, if you had invested in MTAR Technologies, your returns would have been more than impressive – over 45%! Just to put that into perspective, the Nifty 50, a stock market index, gave around 10% returns during the same time frame. That’s quite a difference.

These two stocks related to current sentiment of Aditya L1 are potential growth stocks for now, do your own research before investing.