As per the data and market structure, Nifty is anticipated to showcase a dynamic performance on August 16th. Factors such as Inflation Rate, and global market trends are expected to influence the index’s movement.

Nifty has taken support from 19300 support level twice in this month of August and now there are some important support and resistance levels that will decide the upcoming market structure and movement for tomorrow.

Nifty Resistance Levels

- 19520

- 19611

- 19664

Nifty Support Levels

- 19320

- 19230

- 19140

These are some important levels for Nifty that market will try to reach in the upcoming trading sessions and traders can make their trading plan as per these levels.

Note: Please Use these support and resistance levels on 5 or 10 minute time frame only. The support and resistance levels will be different based on different time frames.

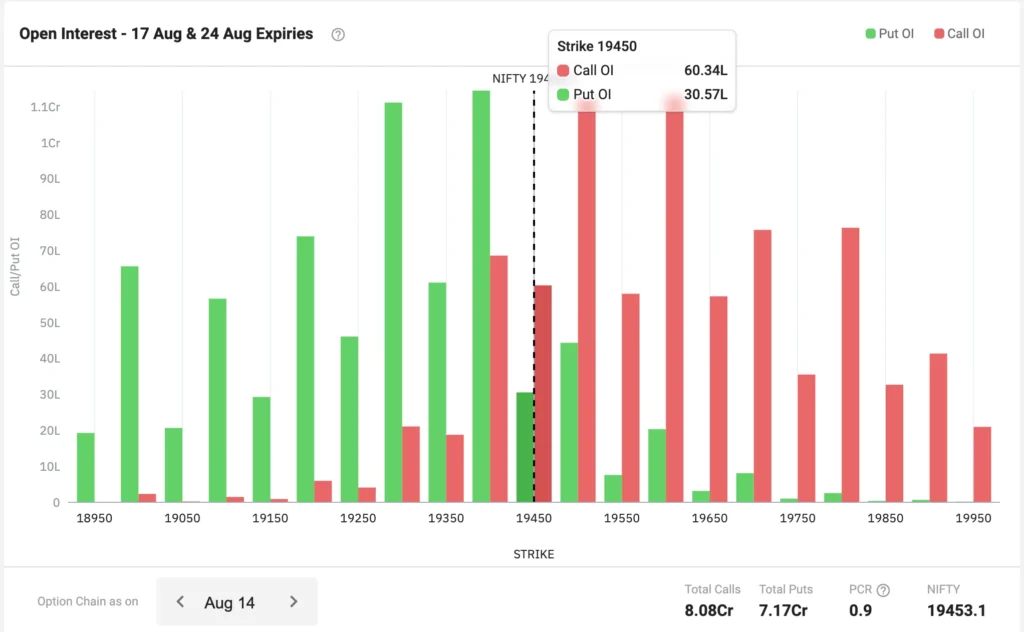

Nifty Option Chain Data

As per Nifty’s option chain data, Call Writers are more than Put Writers at ATM Strike Price but if we analyse next round level strike prices then overall this data is suggesting Sideways to Bearish Data.

Moreover, PCR 0.9 is also suggesting complete sideways data for now. Any changes in this data will lead the market, you can Paper trade check the updated OI Data on Sensibull for free.