Concord Biotech Limited has launched its IPO in the Indian Markets and today is the last date to apply for it but still if you are doubtful and wanted to know more about this then this post has everything you need to know!

- Bidding Dates: 4-8 Aug

- Min. Investment: ₹14,100.00

- Lot Size: 20 shares

- Issue Size: ₹1551 Cr

About Concord Biotech Limited

Established in 1984, Concord Biotech is a company in the field of medicine and biology. They are known for creating and making important components used in medicines through a process called fermentation. These components are used in medicines that help control the immune system and fight cancer. They are quite popular and their products are used in more than 70 countries, including the USA, Europe, Japan, and India.

In India, they operate in 20 states and five union territories. They make 23 different components that go into medicines, like ones that stop infections and treat cancer. These components help people who have had organ transplants, those with problems in their immune systems, and people with cancer and kidney issues.

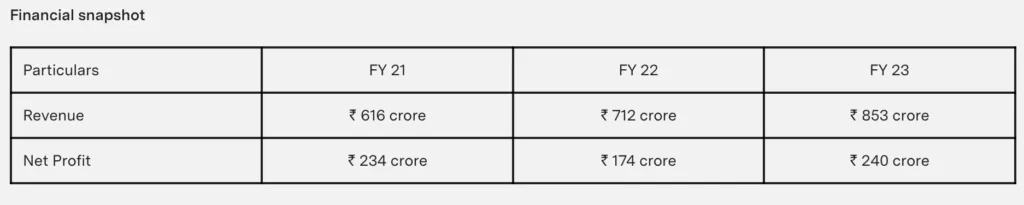

From 2021 to 2023, Concord Biotech’s business has grown by about 11.4% each year. This means they are making more money from their operations. And for the last three years, they have been making a good amount of profit, more than 20% of their earnings.

In the future, the global market for the kinds of components they make is expected to keep growing. This could help Concord Biotech make even more money.

Concord Biotech Limited IPO GMP Today 08/08/23

Today, the price people are willing to pay for Concord Biotech’s IPO shares before they even officially go on sale is ₹202. This is higher than the ₹153 price on Monday.

Experts think this increase is because a lot of people want to buy these shares and the stock market in India is doing well. If the stock market keeps doing well, this price might keep going up.

People who watch the market are saying that today, the price people are willing to pay for Concord Biotech’s IPO shares before they officially go on sale is ₹202. This suggests that the unofficial market expects the price when the IPO shares start trading to be about ₹943 (which is ₹740 + ₹202). This expected price is about 27% higher than the range of prices set for the Concord Biotech IPO, which was between ₹705 and ₹741 for each share.

Concord Biotech Limited IPO Subscription Status

As of 11:39 AM on the third day of the bidding process, people have shown interest in Concord Biotech’s IPO by subscribing 3.73 times the number of shares available to the public. Among these, the part reserved for regular investors has been subscribed 2.68 times.

In the category for institutions and large investors (NII), the demand has been strong, with a subscription rate of 7.23 times, while the portion set aside for qualified institutional buyers (QIB) has been subscribed 2.92 times.

Additionally, employees who are eligible and want to invest in the IPO have a special offer. They can get a discount of ₹70 for each share they buy in the Employee Reservation Portion.