15x15x15 Formula: If you are living in India, a middle class person generally plans somewhere around 10-15 crore for his retirement and spends more than 55 to 60 years to achieve that goal.

Today, we have a formula for you to become financially free at early and hence you can retire at the early. but remember that if you want to retire earlier, then you have to plan earlier, so read this post carefully.

Criteria to Proceed with 15x15x15 Formula

There are certains condition that you should meet if you want to apply this 15x15x15 Formula in your financial planning:

1. First, you should have a Source of earning from Job or Business.

2. You will have to save money from your Income to invest monthly.

15x15x15 Formula

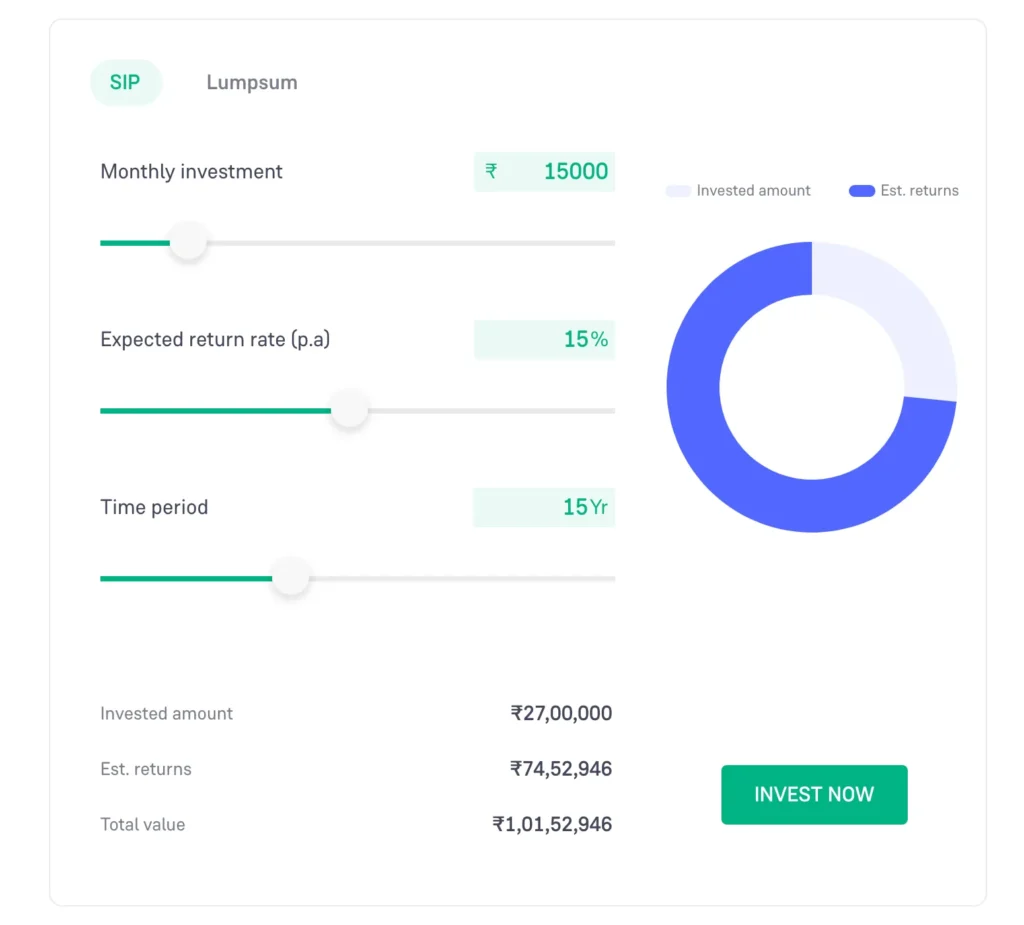

The 15x15x15 Formula means you will have to invest 15000 rupees per month in a mutual fund which is giving average CAGR of at least 15% for 15 Years.

The only rules in this formula is be disciplined with your monthly investment and never default on it for the next 15 Years.

If you will be able to do this, then gradually you will see the magic of compounding which means as your investment grows it automatically becomes the Principal of your invetment.

Amount After 15 Years

Now, let’s calculate the amount that you will get after 15 Years. Upon investing continuously for 15 Years your principal amount will be 27 Lakh and the final amount based on an average 15% annual return will be 1,01,52,946.

Conclusion

And that’s how you become a Crorepati with the investment with the mutual funds but no doubt it takes a lot of discipline and patience to achieve this target.

However, if you have good knowledge of techincal and fundaments aspects of the markets then you can achieve that goal very early through investing in good stocks on dips.

I hope you have understood the 15x15x15 Formula, if you like it then let us know in the comments section below and don’t forget to share this post with your loved ones.