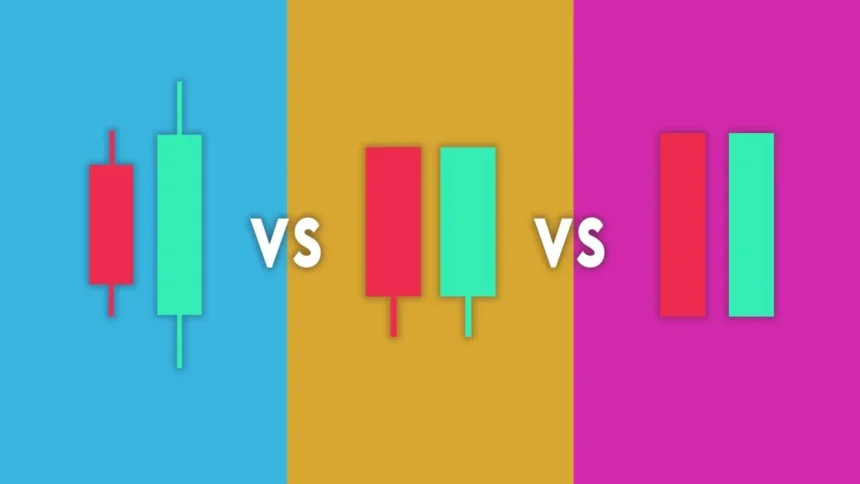

Price is the leading indicator, and the best way to truly understand price is to look at Japanese candlesticks.

As traders, we use Candlestick Charts to analyze and interpret price charts in the financial markets. It’s our key in technical analysis. Each candlestick represents a single period, whether it’s a minute, an hour, a day, or another timeframe. Here’s a breakdown of how Japanese candlesticks work:

Components of a Candlestick:

- Body: The rectangular area between the open and close prices. If the close is higher than the open, it is a bullish candlestick. If the close is lower than the open, it is a bearish candlestick.

- Wicks (or Shadows): The lines above and below the body, which represent the highest and lowest prices during the time period where the candlestick is forming.

Types of Candlesticks:

- Bullish Candlestick (Green or White): The close is higher than the open. It suggests buying interest and bullish sentiment.

- Bearish Candlestick (Red or Black): The close is lower than the open. It suggests selling pressure and bearish sentiment.

Candlestick Patterns:

There are mainly 2 types of candlestick patterns, single and multiple.

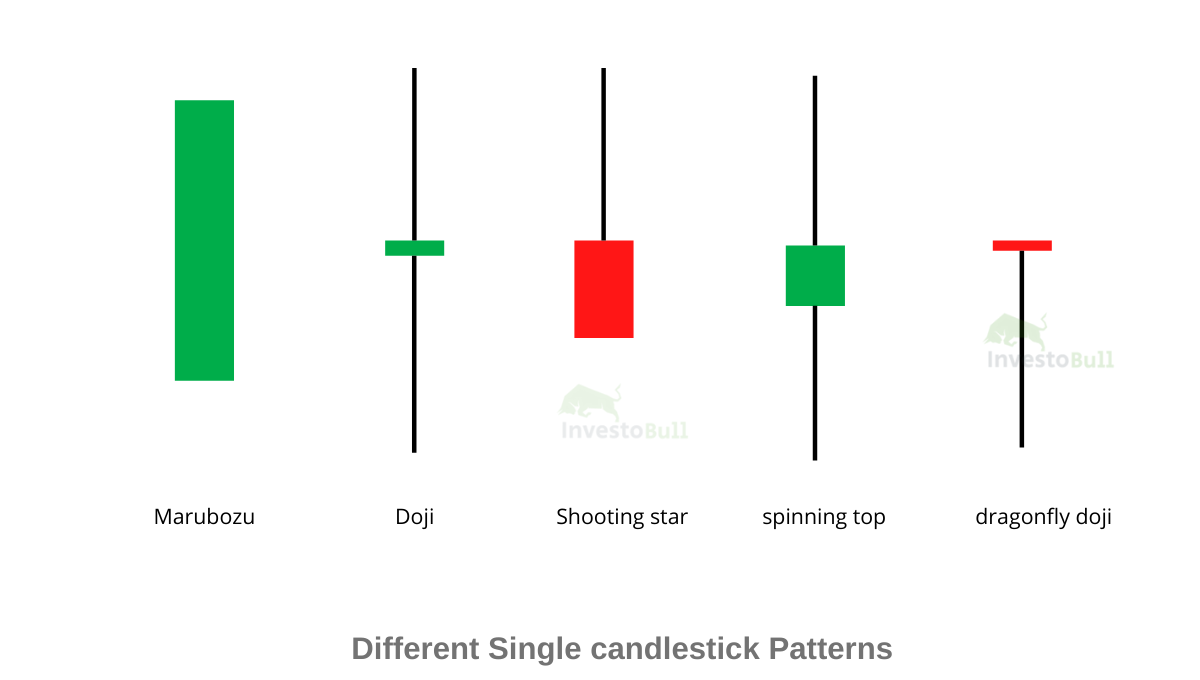

- Single Candlestick Patterns: Simple patterns like the Hammer, Doji, and Spinning Top, which can signal potential reversals or indecision in the market.

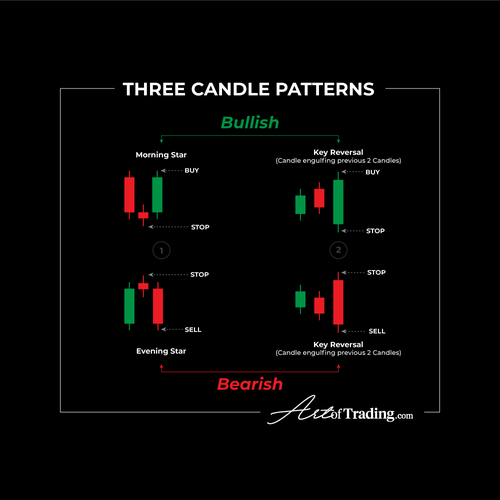

- Multi-Candlestick Patterns: Combinations of 2 to 3 candlesticks and are often used to identify trend reversals or trend continuation. Examples include the Engulfing Pattern, Three White Soldiers, and Three Black Crows.

When it comes to candlestick patterns, there are hundreds of candlestick patterns. BUT the truth is you don’t need to memorise EVERY single candlestick pattern. In fact, you don’t even need to memorise half. If you can understand candlesticks momentum, selling and buying pressure, you don’t even need to memorize candlesticks patterns at all.

But my recommendation would be for you to choose 3 candlestick patterns and focus on trading those patterns.

This means that your job is to spot for any one of the 3 candlestick patterns when trading.