Multibagger Stock: In just 10 days after going public, the Indian Renewable Energy Development Agency (IREDA) has seen its shares skyrocket by a whopping 52%. This rapid rise has put IREDA on everyone’s radar as it rides a wave of positive momentum. Investors are eager to know: What’s behind this incredible surge in value? Let’s understand the story of IREDA’s remarkable journey into the heart of the green energy revolution.

Company Essentials

The Green Energy Catalyst

The driving force behind IREDA’s rapid increase lies in the Indian government’s proactive stance towards promoting renewable energy. With a dedicated focus on the power and electric vehicle (EV) sectors, investors are flocking to capitalize on the promising future of the renewable energy industry.

The government’s emphasis on green energy initiatives aligns with global environmental goals, making investments in companies like IREDA particularly appealing. As the nation continues its sustainable energy push, IREDA stands to benefit significantly from this trend.

IREDA Share Price Target 2023, 2024

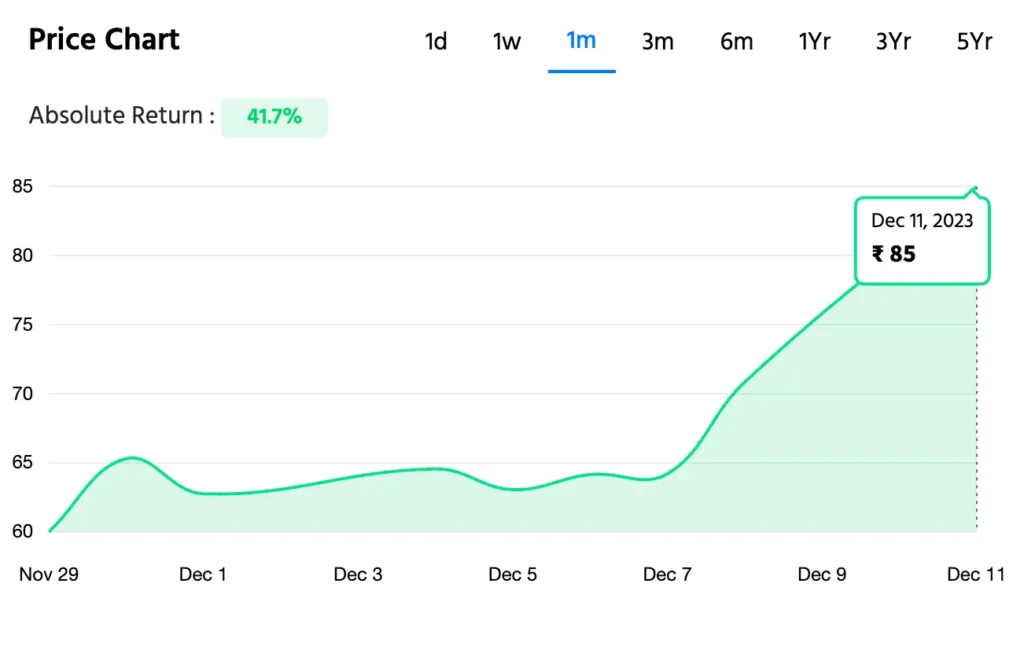

Considering IREDA’s current trading value at 102, experts recommend a strategic long-term approach, suggesting a minimum holding period of four years for potentially lucrative multibagger returns. The share’s current trajectory points towards a positive outlook, with a price target of 130 by the end of 2023.

Looking even further ahead, projections indicate that IREDA’s share could surpass the 200 and 250 marks in the years 2024, presenting a compelling opportunity for astute investors.

As the green energy wave continues to rise, IREDA stands at the forefront of this transformative journey. For those considering an investment, a long-term vision may unlock substantial gains in the evolving landscape of renewable energy.