Today’s trading session in the Nifty 50 has been an intriguing one, with market dynamics indicating several trends and insights that traders should pay attention to. In this article, we break down the data and options information that can help you navigate the current market with confidence.

Advances vs. Declines Today

One key indicator of market sentiment is the ratio of advancing to declining stocks. As of the latest data, there are 7 advancing stocks compared to 43 declining ones. This discrepancy suggests that a significant number of stocks are currently under pressure, which may impact the overall market direction.

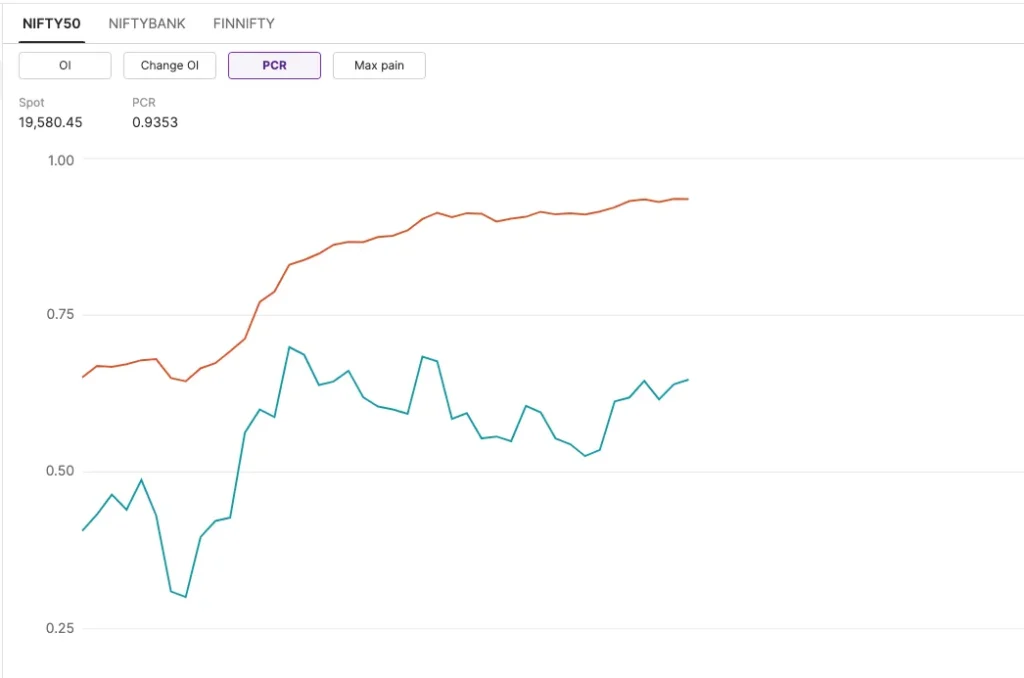

Nifty PCR Today

The Put-Call Ratio (PCR) is a critical tool for gauging options sentiment in the market. The current PCR stands at 0.9. A PCR below 1 suggests a bullish sentiment, indicating that more traders are buying calls than puts.

However, it’s important to keep in mind that the market is dynamic, and these sentiments can change rapidly.

Nifty Max Pain: 19600

Max Pain is the point at which options traders believe that the most options contracts will expire worthless, causing the least amount of financial pain to option writers.

The Max Pain level for today’s trading session is at 19600, which means that options traders anticipate that this level is where the least financial pain will be inflicted. This level can act as a magnet for the market, potentially influencing price movements.

Options Open Interest (OI) at the At-The-Money (ATM) Level

Options Open Interest (OI) at the At-The-Money (ATM) strike prices is a crucial metric. Currently, there is a significant amount of Open Interest, with 280 lakh (2.8 million) contracts for call options and 242 lakh (2.42 million) contracts for put options. This high OI suggests that traders are closely watching and positioning themselves around the ATM strike prices, which can influence price actions.

As a trader, staying informed about these key data points can help you make more informed and strategic decisions in the market. It’s essential to remember that the market is dynamic, and trends can change rapidly. Therefore, regular monitoring of these indicators is crucial for successful trading.

Please note that this article is for informational purposes and should not be considered as financial advice. It is essential to conduct thorough research and consult with a financial professional before making trading decisions.

Stay tuned for more updates as the market continues to evolve and provide exciting trading opportunities.